REVERSE MORTGAGE FOR PURCHASE

GOOD OPTION FOR ...

Homebuyers, age 62+ that are looking to:

Right-size to a smaller home or a lower maintenance home

Buy a home closer to family or friends

Lower their cost of living in retirement by elimination monthly mortgage payments

Enjoy care-free living in a 55+ senior housing community

HOW DOES IT WORK...

All borrowers must be age 62 or older

If spouse is younger than 62, will not be eligible to be a borrower but can be a Non-Borrowing Spouse.

Reverse mortgages is just a loan! Borrower still has full ownership of the property (stays on deed).

Reverse mortgage is a 1st lien loan like a regular mortgage.

Benefit amount based on Age, Home Value & Current Interest Rates.

No minimum credit score.

Must pay property taxes, homeowners insurance, HOA & maintain the home.

All Borrowers are required to go through mandatory FHA Counseling Session.

Reverse mortgage is a Non-Recourse loan which means house is only asset that can be used to pay off debt.

ELIGIBILTY & UNDERWRITING...

This is an FHA loan (government insured)

Property types: SFR, Multi-Unit (2-4 units, must live in one of them), Townhome, FHA Approved Condo

Gift funds can be used for down payment.

NO minimum credit score or income requirements

Credit is reviewed for willingness to repay & income must pass residual income requirements.

Homes can be purchased using a Trust

Seller/Builder concessions ARE permitted up to 6% of the sales price.

Payment Optional Loan meaning NO required Mortgage Payment (Principal & Interest) for the duration of their time in the property.

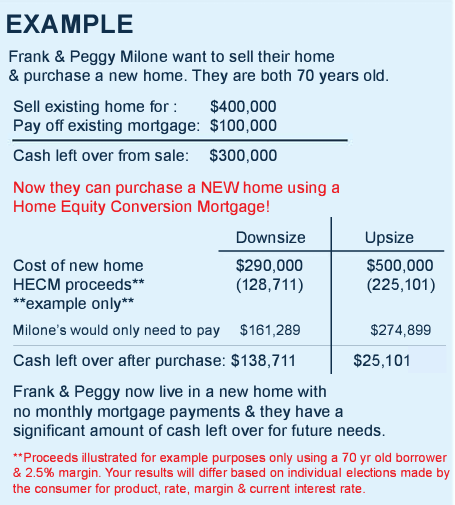

PURCHASE EXAMPLE...

Frank & Peggy Milone, both age 70, are looking to move closer to their grandkids in a single story home with less upkeep.

They will be selling the large home they raised their family in and will net $300,000 from the sale.

Retired and on a fixed income, they don't want a new mortgage, so they are looking to pay all cash for a $300,000 home or less.

DOWNSIZE - $300K OR LESS...

Option 1: Use all of the $300,000 from the sale of the previous home.

Option 2: Preserve some cash using a Reverse for Purchase Mortgage:

Put down payment of $161,289 from sale of home and combine that with a HECM Mortgage of $128,711.

Benefits to Borrower:

Still purchase the home with NO mortgage payment required, just responsible for taxes, insurance, and HOA.

BUT NOW, have $138,711 cash in the bank to use in retirement.

*Used the Reverse Mortgage to preserve cash of $138,711 for use in retirement AND still bought the home with NO required monthly mortgage payment.

UPSIZE - $500,000...

UOption: Use a Reverse Mortgage to increase their purchasing power.

Combine $274,899 cash with HECM Mortgage of $225,101 to purchase a home up to $500,000 in value and have $25,101 left over for emergencies.

Benefit to borrower:

Still purchase the home with NO mortgage payment, just pay taxes, insurance, and HOA (like you always do).

BUT NOW, use the reverse mortgage to increase your purchasing power and buy MORE HOME than they could afford with just CASH!

*Used the reverse mortgage to INCREASE PURCHASING POWER and BUY MORE HOME than they could afford with just their cash and still have NO required monthly mortgage payment.

LOAN COMES DUE...

At the sale of the home, last borrower passes away, or last borrower permanently leaves the Home (12 consecutive months of non-residence)

There are protections for under age 62 spouses (Considered a non-borrowing Spouse)

In the event of foreclosure, which only happens if insurance and property taxes are not paid just like a regular mortgage.

Ready to Buy Your Dream Home with No Monthly Mortgage Payments?

With a Reverse for Purchase Mortgage, you can combine the benefits of a reverse mortgage with the opportunity to purchase a new home that fits your lifestyle. It’s a smart and flexible way to make your move while keeping more money in your pocket. Let us show you how!

**In order to do an estimate, I will need your address, date of birth, and gross monthly income. Once you have decided to make a full application, we can do that in person, over Zoom, whatever works best for you :) The above information helps me give you the most details regarding your situation for our initial consultation. I do not ask for social security numbers until I know you are ready to proceed with the application. Your email and phone number will not be disclosed and you can choose to opt out on your information being sold once your credit is pulled.